MONEY

FOR HEALTH.

Starship is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.

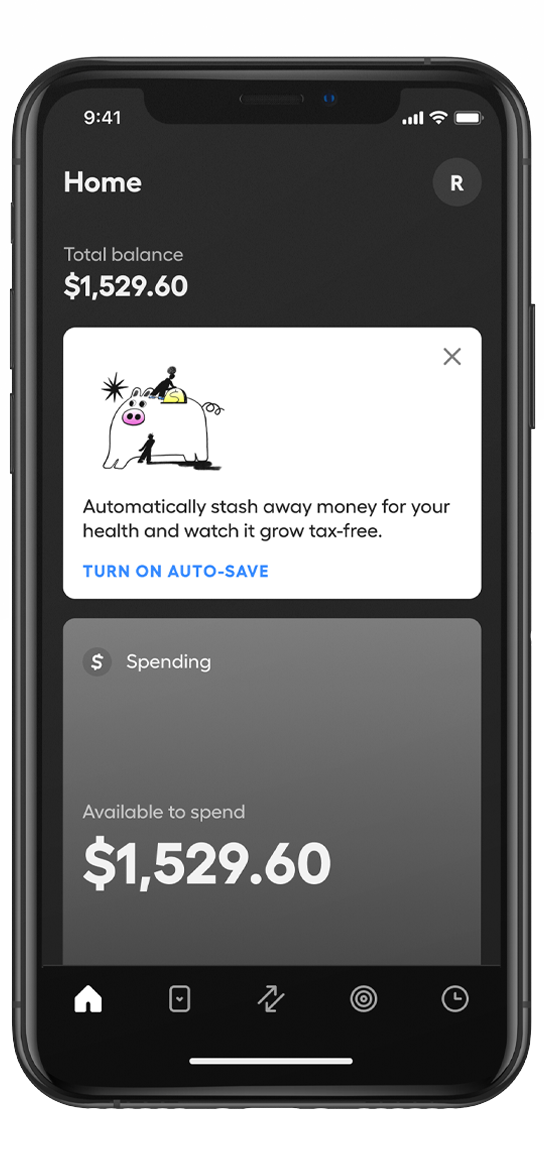

The HSA

built for you.

Spend, save, and invest your health dollars tax-free, all in one place.

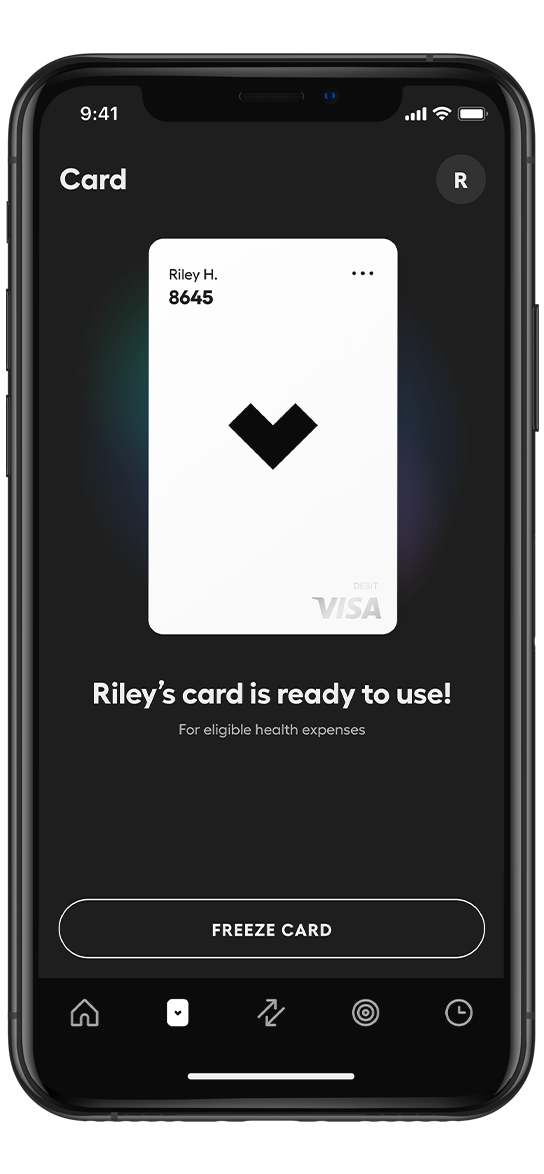

Save big on eligible,

everyday items.

Swipe or tap your Starship Visa® Debit Card when paying for eligible purchases and enjoy the tax savings.

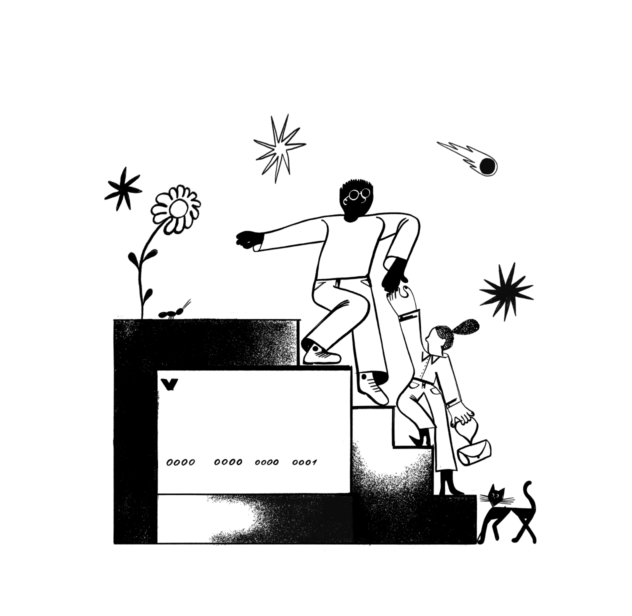

You’ll be in

good company.

Built by experts, so you don't have to be.

Your money is protected

with Starship.

Spending accounts are FDIC insured up to $250,000.* Investing accounts are protected by the SIPC up to $500,000.